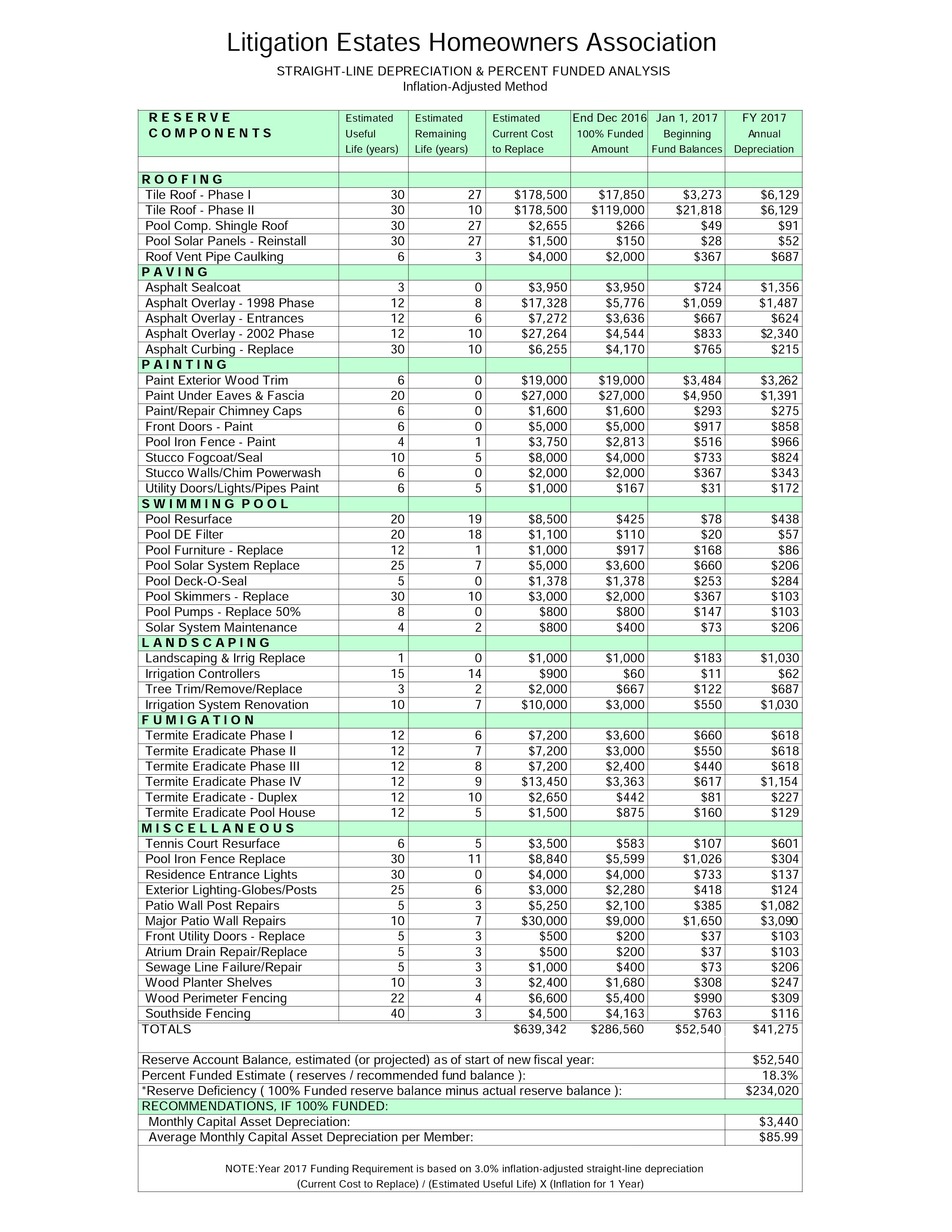

Following is an example of a Straight-Line Depreciation Analysis report. The purpose of a Straight-Line Depreciation Analysis report is threefold:

In the following Straight-Line Depreciation Analysis sample report, you can see that the sample association has the following measures of reserve fund status:

To summarize what was said above so you can view the numbers in the above report:

NOTE: Board members commonly make the mistake of choosing the Straight-Line Depreciation Analysis method of funding and assuming they only need to fund their reserve budget enough to offset their "FY2005 Funding Requirement" (

$41,275 in this case) for depreciation expected to occur in FY 2005. This is fine if the association is 100% funded for depreciation-to-date.

However if the association is running a reserve deficit, as in this example where they only have

18.3% of the cash in reserves necessary to offset depreciation-to-date, they also need to get serious about reducing their unfunded depreciation liability. In other words, they'll need to supplement their reserve funding plan to offset the

$41,275 of annual reserve depreciation with extra funds to reduce their unfunded depreciation liability.

The

Optimized Cash Flow Analysis method determines a reserve funding plan that will help reduce the reserve deficit, but doesn't guarantee the association's reserves will be 100% funded during all years. For more information, refer to the

Cash Flow Analysis page.

Return To Top

Stone Mountain Corporation

Re$erve Studies

Stone Mountain Corporation

Re$erve Studies

Stone Mountain Corporation

Re$erve Studies

Stone Mountain Corporation

Re$erve Studies